RICHARD TRUESDELL May 25, 2022 All Feature Vehicles

In the aftermath of the world record price of $26.5 million for one of 10 Ferrari 275 GTB/4 N.A.R.T. Spiders, there’s been increased attention, much of it in the mainstream financial press, of the investment potential of collectible automobiles.

Breakthrough prices at auction are a byproduct of a confluence of factors. These include a rare, blue-chip automobile, at least two highly motivated bidders, and for the super wealthy, the belief that the possible return on investment exceeds those found on competing financial opportunities such as stocks, real estate, or even works of art.

Is an investment-grade automobile a work of art? To many of us, the answer is an unequivocal yes. Quite a few of us feel that a one-off custom car, whether it was designed and built by Pininfarina or Troy Trepanier, is a work of art with the undeniable advantage of returning to its owner the joy of getting behind the wheel.

But there are risks involved, and there’s a historical precedent: the well-documented investment car bubble of the early ’90s. Throughout the go-go ’80s, there was a sustained and unchecked run up in prices, most notably in the exotic car sector where not only rare Ferraris increased in value at an unprecedented rate, but they took lesser Ferraris (if there is such a thing) and other exotic cars along for the ride.

When the bubble burst in 1990, the much-derided Yuppies who had invested their stock bonuses in classic cars as well as new Porsche 911s, Aston Martins and Lamborghinis, soon found themselves upside down in a market in free fall. Not having a clear understanding of the market dynamics in place, they became victims of the “pigs going to slaughter” mentality and lost their shirts in a collector car market that took more than a decade to fully recover.

If you’re reading Maximum Drive, it can be said that you have more than a passing interest in cars, especially classic muscle cars from 1964-73, when rising insurance rates, strangling emission regulations, and the first OPEC Oil Embargo brought this golden age to a screeching halt. If you look back at a used car lot in 1975, you might see high-powered muscle cars selling for a pittance, a far cry from 30 years later.

What transpired in the intervening years is that Baby Boomers, those of us who came of driving age from 1965 to 1980, got good jobs, acquired some wealth, and started to have disposable income now that our kids were fleeing the nest, either going to college or out on their own (how quaint that all seems now). And many of us had a piggy bank that we could tap to buy that ’70 Chevrolet Chevelle 454, Boss 429 Mustang, or a Hemi-powered Mopar that was beyond our reach when we were in high school or college. It was our house that rapidly had appreciated in its own bubble, with equity that could buy the car of our dreams.

“is an investment-grade vehicle a work of art? to many of us, the nswer is an unequivocal yes. ”

At the same time, our wives would often say, “If you’re going to buy that muscle car, I want to update the kitchen.” And many of us did just that, we bought cars, updated kitchens or took that round-the-world cruise—sometimes all three—depleting the equity that took years to build in a heartbeat, thinking that our houses would continue to grow in value.

It didn’t quite work out that way, and the signs were there even before the financial markets collapsed in 2008. Attend any high-profile auction in 2007 and the seeds were already planted as housing appreciation was showing signs of slowing. And this was reflected in the prices of what I’ll call the broad mid-range, cars selling from $30,000 to $250,000 covering a wide variety of categories, but really visible in the muscle car and pro-touring categories.

I remember one auction where seven ’69 Ford Mustang Boss 429s were offered for sale. Think about that, Ford built 859 Boss 429s in 1969, and here, at one auction, was almost 1% of all 429 Boss Mustangs built. The result? While one car met its pre-auction estimate, having six other cars vying for the attention of buyers resulted in prices that failed to meet the expectations of sellers. The handwriting was on the wall.

The following year, as the financial markets crumbled, was the start of the real carnage. Remember that Baby Boomer who bought that 454 Chevelle while his wife renovated the kitchen or who took that cruise? As home equity loans were called in by scared banks, what was the most liquid? The car, the kitchen or the cruise? We all know the answer, and the result was dozens of high-quality cars entering the marketplace and prices started their downward trend. After all, Chevrolet built more than a handful of 454 Chevelles, many more than the number of Boss 429 Mustangs Ford manufactured. In spite of their iconic status, with so many for sale, prices plummeted. Remember Economics 101 in college, supply and demand, where the X- and Y-curves meet. In 2009, the supply exceeded demand for all but the best cars in the market. Carnage, like in 1990, was the result.

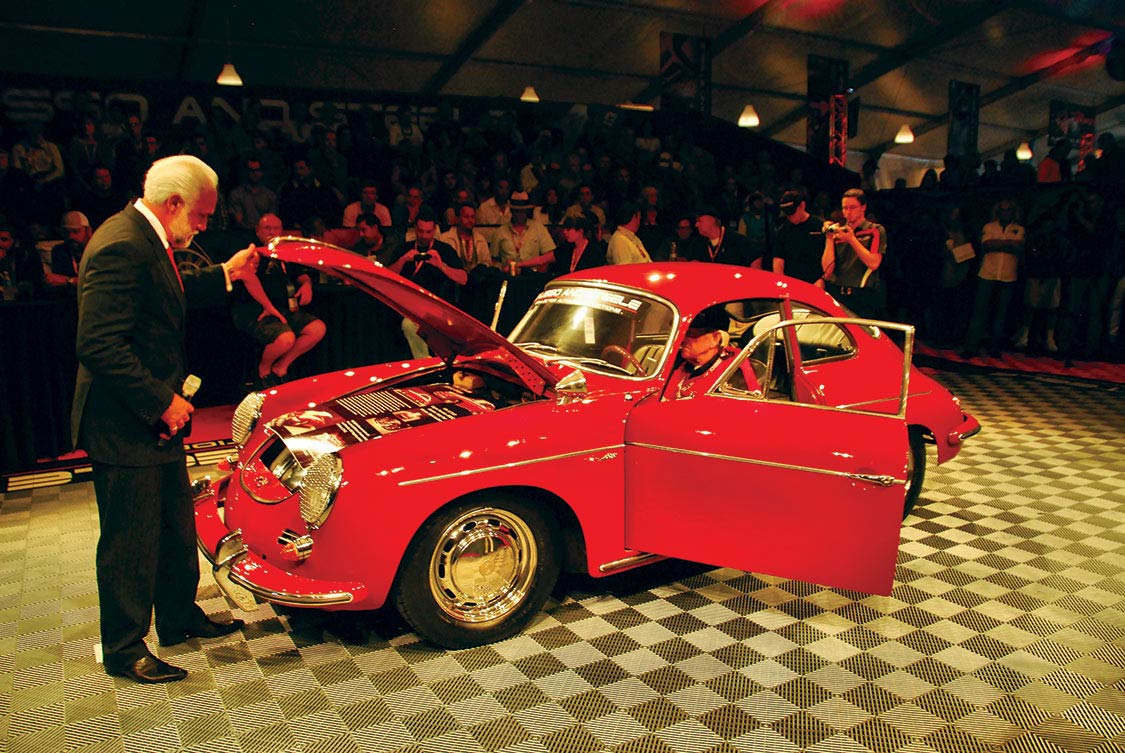

The other example that I like to cite are pro-touring and resto-mod cars. How many times have you watched an auction on TV (Barrett-Jackson and Russo and Steele being the best examples) and a car crosses the block that you knew, if you tried to build it, it would cost $150,000 or more, only to see it struggle to sell for half that or less. Watching the proceedings, you knew someone, the car’s builder or seller, had just taken a huge hickey and the buyer bought a car for less than the cost to build a similar version from scratch. A seller’s market turned into a buyer’s market in less than two years.

At the same time we were witnessing the decline of the muscle car, pro-touring and resto-mod categories, on both sides of the Atlantic, at auction after auction, from the RM, Gooding and Bonhams houses especially, we started seeing rapid appreciation in rare Ferraris, Mercedes-Benzes and Porsches. Why? How were the fundamentals different from American iron?

First, and probably most important, was that in many instances we’re talking about cars built in very low numbers with many having documented competition history. Second, this documented provenance has brought well-heeled buyers into the market at a time when paper assets, stocks especially, were declining in value. Factor in rates paid on savings deposits falling to all-time lows thanks to the Fed’s program of printing money and quantitative easing. Real estate? That category is only now recovering, albeit slowly. With the trends accelerating at the start of 2009, collector cars, a hard asset like gold, started looking like a great place to position cash.

And given the rarity of many of these cars, if two or more buyers wanted to acquire these assets, bidding wars were the result. Sellers were happy, auction houses were happy, and in many instances, buyers were happy as they acquired assets that they felt would continue to rise in value. Have we seen this scenario before? I belive you know the answer.

But this hasn’t stopped appreciation of certain European cars, the best case being the landmark Mercedes-Benz 300SL gull wings and the roadsters that followed. Where just two years ago you could find concours-level 300SL roadsters for $500,000, at this year’s Monterey auctions, all of the top gull wings and roadsters sold for more than the magic million-dollar mark with there now being virtually no difference between the gull wings and roadsters, even though the open top 300SLs were built in significantly greater numbers (1,400 gull wings vs. 1,858 roadsters). In fact, in the eyes of many experts, the Mercedes-Benz 300SLs are undervalued compared to their Ferrari counterparts. Don’t be surprised if we see a non-alloy-bodied 300SL (the rarest of the series) top out at $2,000,000 or more.

Looking for a bargain? Look to Aston Martin. While a concours-level DB5 finished in Silver Birch—made famous by Secret Agent 007 in Goldfinger—is going to command a premium, earlier DB2s and DB4s, and later DB6s all offer similar pleasure behind the wheel, but are priced significantly less. Many low-volume Alfa Romeos offer similar opportunities, especially with Alfa Romeo about to return to U.S. showrooms in 2014 with the stunning 4C coupe (read more in this issue, “2014 Alfa Romeo,” pg. 42). Here you’ll find many outstanding opportunities from both marquees, from $100,000-$400,000.

So where is the market equilibrium right now, as we head into the all-important Scottsdale auctions in January. My crystal ball tells me this. With many rare and significant cars coming up for auction at the high end, prices there will continue to rise for top-tier cars. This will be especially true for non-U.S. cars with documented race history that are eligible for vintage racing and classic car tour events.

If you want to target American-built bargains, those with appreciation potential, I would look to NASCAR stock cars from before the “Car of Tomorrow” era, the cars that ran up to 2007. These offer some positive upside, mid- and long-term. Stepping up a bit, cars from NASCAR’s pre-1972 Winston Cup era, when the cars bore some resemblance to those sold in showrooms, should offer appreciation potential offset by their higher cost of entry.

And another subset of American competition cars is the documented examples that competed in the Trans-Am Championship. Camaros, Mustangs, Javelins, Challengers, Barracudas and Cougars, especially those that enjoyed factory sponsorship, when they come available they’re worthy of your consideration.

Muscle cars and the previously mentioned pro-touring and resto-mod examples will continue to offer significant bang for the buck in the current marketplace as muscle car pricing may have bottomed out. Muscle cars, once the current glut of cars clears out, will offer appreciation opportunities long-term, while pro-touring and resto-mod cars will likely never sell for more than they can be bought for now, and will rarely sell for what they cost to build.

Age also plays a part in value determination, especially for American cars, and unlike European cars, it has a negative impact. With so many Tri-Five Chevys having been built and restored throught the past 20 years, and their main enthusiasts base now in their sixties, expect that market to soften for all but the absolute best cars, even Nomads and Bel Air ragtops. This is because the supply and demand conundrum will start pushing prices down, as it has already done for many pre-war classics. There are only so many spots in museums for these cars to find new, long-term homes.

As I write this there’s a feeling that Corvette prices may have also reached their near-term zenith. At October’s Mecum auction, a very significant Covette, a ’63 Sting Ray once owned by a GM Styling VP, fell short of expectations, selling for $925,000.

In the aftermath of generally solid Corvette results this past summer, the fact that this car sold for less than $1,000,000, was a huge disappointment to many Corvette enthusiasts. Is this the portent of things to come, or just a momentary retraction in the market? The Scottsdale auctions in January, with so many Corvettes on offer, some with significant history or past celebrity owners, will give a clear idea for Corvette prices in the near term.

No matter your interests, if you’re a serious buyer, do your homework. All of the major auction companies document their previous sales, some going back five years or more, making it easy to track comp sales, much more than at the time of the last boom/bust in 1990. And I haven’t mentioned eBay yet. Using eBay’s completed auctions search function, it’s easy to see and track many recent individual transactions, helping you gauge market trends, especially for American cars, adding to the database you can develop on cars that you want to acquire.

Happy hunting.

Auctions

America

Bonhams

Barrett-Jackson

Gooding

Leake

Mecum

RM

Russo and

Steele